Google To SEC: Reporting On Mobile CPCs And Clicks Would Not Be Meaningful, Too Confusing

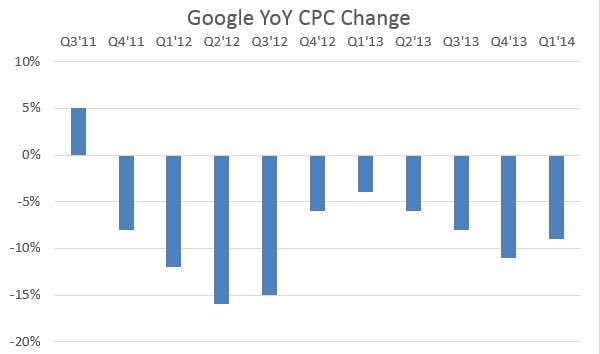

The average cost-per-click advertisers pay for Google ads has been declining year-over-year since the fourth quarter of 2011. The rise of mobile has long been seen as the driving force behind the declining average cost-per-click (CPC) — a glut of new ad inventory coupled with the fact that many advertisers often discount the value of […]

The average cost-per-click advertisers pay for Google ads has been declining year-over-year since the fourth quarter of 2011. The rise of mobile has long been seen as the driving force behind the declining average cost-per-click (CPC) — a glut of new ad inventory coupled with the fact that many advertisers often discount the value of mobile ads compared to those on desktops and tablets.

Google has been cagey about providing detail on the influence of mobile on its business and reports only aggregated changes in CPC and click volume. In a newly released Securities and Exchange Commission (SEC) filing, the company aims to justify why it does not share more information about the impact of mobile advertising on its business with investors.

The SEC had asked Google to provide more information about what had caused the 6 percent decline in average CPC the company reported in its Q4 2012 earning statement. More specifically the SEC wanted to know if the “decline is primarily attributable to mobile advertising” and if, so to “explain why quantification of mobile activity would not be meaningful”.

First, let’s look at what Google wrote in its 2012 earnings report about the CPC drop:

The decrease in the average cost-per-click paid by our advertisers was driven by various factors, such as the general strengthening of the U.S. dollar compared to certain foreign currencies (primarily the Euro), the revenue shift mix between Google websites and Google Network Members’ websites, the changes in platform mix due to traffic growth in mobile devices, where the average cost-per-click is typically lower compared to desktop computers and tablets, and the changes in geographical mix due to traffic growth in emerging markets, where the average cost-per-click is typically lower compared to more mature markets.

- foreign currency exchange

- a change in revenue mix from advertising between Google search and Google Display Network

- traffic growth from mobile devices, where the average CPC is lower than desktops and tablets

- growth in emerging markets.

The extent to which that third item, mobile traffic growth, is depressing CPCs — and an explanation of why providing this detail wouldn’t be helpful to investors — was what the SEC was trying to discover.

“Misleading and Confusing”

In response to the SEC’s inquiry, Google wrote, “disclosing or quantifying the impact of only one factor, such as platform mix, could be misleading and confusing to investors.”

Google writes that the 6 percent drop in CPC in Q412 was “primarily due to an ad product change and movements in foreign currency rates.”

Specifically, we implemented an ad format change in Q412 that resulted in users clicking more often on our display Network sites, which on average have lower CPCs. This change was not only a significant driver of paid click increases in the quarter, it also drove approximately 2% of the total 6% decline in CPC growth. Additionally, roughly 2% of the total CPC decline was attributable to foreign currency exchange movements. Neither the decline in CPCs nor the increase in paid clicks were “primarily attributable to mobile” in Q412. (Note: The product change in question was rolled out first to mobile in Q412 and then to desktop in Q113, so while it is technically true that Q412’s decline in CPCs and surge in paid clicks was “mobile” in nature, a similar decline and surge occurred on desktop in Q113, which was the first full quarter the same change affected the desktop platform.)

This explanation only accounts for two-thirds of the drop (2 percent from foreign exchange rates + 2 percent from the rollout of new mobile GDN ads). What caused the remaining 2 percent drop in CPC? There is no mention of emerging markets, or more conspicuously, of the increased traffic from mobile devices that Google had cited in its initial filing.

As justification for not disclosing CPC growth and mobile paid click growth detail, Google goes on to offer two reasons:

- It’s just too confusing for us to understand. “In the case of Q412, disclosure of mobile CPC growth and mobile paid click growth could potentially have led investors to incorrectly attribute the impact of a product change (and subsequent property mix shift) to platform mix shift.” Is Google now saying they’re not seeing a platform mix shift from desktop to mobile? Or that they wouldn’t have been able to clearly explain that there was a product change that rolled out on the Google Display Network on mobile devices?

- Mobile can’t be broken out because the definition of what a mobile platform is keeps changing. Google first explains that its own definition of mobile quickly narrowed to include only “handsets” (phones) instead of phones and tablets. The company then adds that the definition of mobile could soon expand substantially to include all kinds of “smart” devices such as “refrigerators, cars, thermostats, glasses, and watches”.

Google essentially gave the politician’s dodge to the SEC’s questioning — offering up a rather easy-to-grasp explanation as evidence of why providing this information could be “confusing and misleading”, and skipping over the matter of increasing traffic from mobile devices altogether.

At this point in time, refrigerators and thermostats aren’t included in Google’s definition of mobile. Smartphones alone constitute “mobile” devices in Google’s definition.

Google goes on to make a reasonable case that CPC and click volume should be considered together. How much does it matter that CPCs are declining if click volumes and revenue keep rising?

Yet, if investors shouldn’t be concerned about the impact of flagging mobile CPCs because mobile clicks are more than making up for it, and we have a clear line in the sand of what constitutes a mobile device at this time, then why not report on it or at the very least explain what impact it had on the quarter in question?

Google concludes its response to the SEC by offering up this carrot:

“While we do not believe that telling investors about a sub-category of multi-device ad revenue (i.e., handset revenue) is meaningful, we do believe that the eventual disclosure of revenues generated from digital content/apps, and/or hardware will likely be meaningful, when they reach material levels.”

Essentially, the company says, the information you asked for isn’t relevant so we’re not going to give you a real answer, but someday we just might tell you how much we make from these other products that you didn’t ask about.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories